Musk's future has become more uncertain.

On November 4th local time, according to foreign media reports, the Norwegian Government Pension Fund Global, one of the world's largest sovereign wealth funds, has made it clear that it will vote against Tesla CEO Elon Musk's "trillion-dollar compensation plan" at the upcoming Tesla annual shareholder meeting.

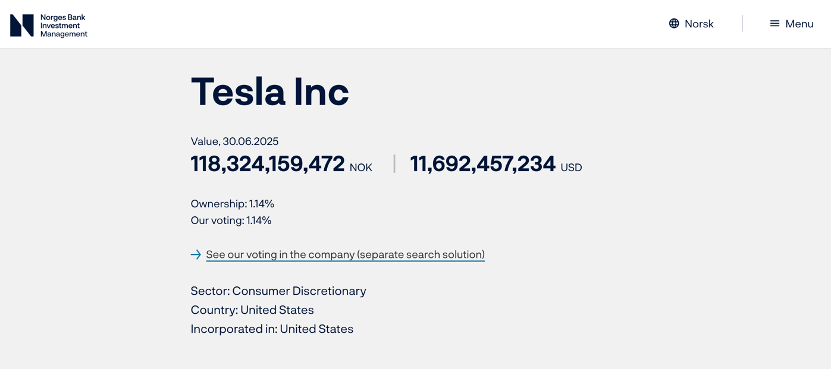

This fund is the largest of its kind globally and the seventh-largest single shareholder of Tesla. According to its website, the fund holds 1.14% of Tesla's shares. The investment is valued at approximately 118.3 billion Norwegian kroner (about US$11.7 billion).

NBIM, the Norwegian investment management firm that manages the fund, stated, "While we appreciate the immense value created by Mr. Musk's visionary leadership, we are concerned about the total size of the incentives, equity dilution, and the lack of safeguards against key personnel risks—a concern consistent with our views on executive compensation. We will continue to engage in constructive dialogue with Tesla on these and other issues."

In fact, Musk had clashed with NBIM in the past over salary issues.

Last year, NBIM voted against restoring Musk's $56 billion compensation package. Subsequently, foreign media published text message exchanges between Musk and the NBIM CEO, in which Musk declined an invitation to dinner in Oslo, Norway, stating, "When I ask you for help (which rarely happens), if you refuse, then you shouldn't ask me for anything again until you make amends. Friends should help each other."

On September 5th of this year, Tesla's board of directors submitted an unprecedented compensation package of up to $1 trillion for investor approval. This plan could allow Musk to receive more than 423 million Tesla shares over the next 10 years, representing 12% of the company. If successfully implemented, Musk's voting rights in the company could exceed 25%.

Tesla plans to grant Musk approximately 12% of its company shares, with a total value of about $1.03 trillion. The main conditions include: the company's market capitalization reaching $8.5 trillion (currently about $1 trillion), which corresponds to an increase of nearly eight times the market capitalization, or twice the current market capitalization of Nvidia; in addition, all equity awards will be unlocked only after Musk leads the company to achieve several ambitious goals.

According to SEC filings, Musk aims to lead Tesla to achieve the following operational milestones: delivering 20 million Tesla vehicles, 10 million active Full Self-Driving (FSD) subscriptions, delivering 1 million robots, commercially operating 1 million Robotaxi vehicles, and ultimately, up to $400 billion in adjusted EBITDA. During this period, Musk will not receive a traditional salary or cash bonus; the plan relies entirely on equity incentives, which will unlock only upon achieving the relevant performance targets.

This "largest compensation package in history" has sparked widespread controversy and drawn opposition from some observers. Last month, the "Take Back Tesla" movement (a coalition of unions and corporate watchdogs) urged shareholders to reject the agreement. However, Baron Capital, another major Tesla shareholder, has made it clear that it will support Musk's compensation plan.

Tesla will hold its annual shareholder meeting on November 6, where a formal vote will be held on Elon Musk's compensation package. Board Chairman Robyn Denholm has warned that Musk might leave the company if the compensation package is rejected.